UTS - Growing talent with care

We are dedicated to help students feel safe, cared for and respected as they embark upon their educational journey with UTS.

UTS - Growing talent with care

We are dedicated to help students feel safe, cared for and respected as they embark upon their educational journey with UTS.

UTS - Growing talent with care

We are dedicated to help students feel safe, cared for and respected as they embark upon their educational journey with UTS.

UTS - Growing talent with care

We are dedicated to help students feel safe, cared for and respected as they embark upon their educational journey with UTS.

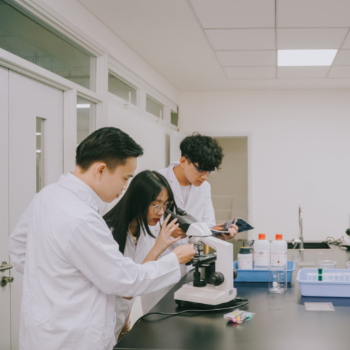

UTS students are always ready for the future full of changes

UTS puts effort into creating a learning environment that meets international standards, facilitating students to become global citizens.

UTS students are always ready for the future full of changes

UTS puts effort into creating a learning environment that meets international standards, facilitating students to become global citizens.

UTS students are always ready for the future full of changes

UTS puts effort into creating a learning environment that meets international standards, facilitating students to become global citizens.

UTS students are always ready for the future full of changes

UTS puts effort into creating a learning environment that meets international standards, facilitating students to become global citizens.

UTS students are always ready for the future full of changes

UTS puts effort into creating a learning environment that meets international standards, facilitating students to become global citizens.

UTS students are always ready for the future full of changes

UTS puts effort into creating a learning environment that meets international standards, facilitating students to become global citizens.

- High quality Learning and Teaching

-

Study pathway

-

Learning programs

-

Summer Program

-

Competency assessment

UTS students learn life-long lessons

Our programs are designed by the Academic council and the partnership with trustworthy educational institutions worldwide.

At UTS, every child is a talent

We believe talent is present in every child, which a dedicated educator can always realise.

At UTS, every child is a talent

We believe talent is present in every child, which a dedicated educator can always realise.

At UTS, every child is a talent

We believe talent is present in every child, which a dedicated educator can always realise.

At UTS, every child is a talent

We believe talent is present in every child, which a dedicated educator can always realise.

At UTS, every child is a talent

We believe talent is present in every child, which a dedicated educator can always realise.

A child needs at least one adult not leaving them behind

UTS is an engaging community where educators, parents are caring trustworthy friends and guiders of every student.

A child needs at least one adult not leaving them behind

UTS is an engaging community where educators, parents are caring trustworthy friends and guiders of every student.

We care all aspects affecting a child’s development

We bring an educational environment where all aspects of a child is genuinely cared.

We care all aspects affecting a child’s development

We bring an educational environment where all aspects of a child is genuinely cared.

We care all aspects affecting a child’s development

We bring an educational environment where all aspects of a child is genuinely cared.

Learning days at UTS are filled with excitement.

UTS students grow through various teaching and learning activities. This nurtures natural, sustainable learning motivation for students.

Learning days at UTS are filled with excitement.

UTS students grow through various teaching and learning activities. This nurtures natural, sustainable learning motivation for students.

Do Parents Know? Guiding Your Children Effective Money Management Habits

TIN TỨC

10/02/2022

In your child’s journey of growth, the lesson of personal finance management is one of the important types of knowledge and greatly affects their development and life later. Money is the main trading unit in the present, we can use money to meet the needs of daily life as well as serve our personal preferences. However, “money” also has many consequences that directly affect our lives. Therefore, education on money management is very essential.

However, instead of educating their children to manage money rationally, some parents tend not to allow their children to be exposed to money as children, while early interpretation to children of the concept of money is very important. In order to form an understanding, thought, and value for money, parents need to give children the ability to understand finances using some of the following methods.

Start With the Basics at a Young Age

According to some studies, the earlier parents begins your child’s money management education, the better, and the appropriate time to start the first lesson is age 7. Because at this age, money habits and attitudes are already formed.

Parents should start with explaining what money is and how it is used. Actually, showing children how money works is more effective. So let them see you making purchases with cash. When making a payment, explain to your child that you’re using money to buy stuff. Then they will understand the money and how to use it in the most specific way.

Instill a Habit of Saving

Your child’s first contact with money will likely involve shopping. After your child understands the function of money, then you need to explain to them where the money comes from and how hard we have to work to earn more income. It’s also a way for your children to be aware that money isn’t just for spending — they should also save money regularly.

You can help your child practice his savings habits by giving the piggy bank or a savings jar so that he can deposit money and set short-term savings goals such as buying a toy he likes or intending for the near future. This helps your child manage money better, clearly distinguish the priority when shopping to spend properly and think carefully before using the money. As they have gotten older, they are now able to save for longer-term goals.

Create Opportunities to Earn Money

Children need their own money to be able to learn how to make decisions about using it. Of course, parents can give your child a small monthly or weekly allowance, but besides, parents should consider creating conditions for your children to earn their own money by doing some housework. However, there are some simple housework such as washing dishes, babysitting… They won’t get paid because this is what a family member needs to do. Parents can come up with some more special tasks such as: cleaning the garden, washing the car …

Help Kids Learn to Make Smart Spending Decisions

With an allowance and self-determination in hand, parents will be worried that your child will quickly spend all that money. However, instead of worrying, you need to explain to your child clearly this will be the amount of money for them to spend for a certain period of time and will not receive more until convention time. Therefore, they need to spend appropriately so as not to encounter unexpected situations. Parents need to help them understand that spending isn’t always about buying what they want. You need to be instructed how to prioritize the use of money for what you need before getting to what’s less important.

Model Good Financial Behavior

Just as important as the lessons parents teach your children, it is that you yourself become an example of managing and using money rationally in front of your children. For example, if you complain about spending too much on certain things and then take your children on a shopping spree, you’re sending mixed messages. Instead, make sure you model the behaviors around money that you want your children to adopt. If you want your children to develop good spending and saving habits, they need to see you making smart spending and saving choices. In short, practice what you preach.

Educating your children about personal finance is a process that can take time and patience. But if you put in the effort and continuously communicate a clear message about money, you will instill good habits that will serve your children well.

Read this next

Topping-out ceremony of UTS Saigon South campus...

Events

01/07/2024

UTS officially tops off its 3rd campus: UTS South Saigon Campus. Parents can find and learn more information here.

Topping-out ceremony of UTS Saigon South campus...

News

01/07/2024

UTS officially tops off its 3rd campus: UTS South Saigon Campus. Parents can find and learn more information here.

Cultural exchange with international friends, UTS-ers confidently...

News

02/07/2024

The Korean Language Club at UTS has collaborated with Gimje Geomsan Primary School (South Korea) to organize a series of exchange activities for primary students from both schools.

A look back at the 2023 –...

News

21/06/2024

The 2023 – 2024 academic year ended with memorable milestones at UTS. Let's review our highlights from the past year, UTS-ers!

UTS Reading Day: Read with me, grow...

Events

25/05/2024

Pocket interesting "tips" when reading books with your child, join for FREE, and receive an admission discount of 40 million VND at the event!

Sustainability – A new subject that UTS...

News

05/04/2024

Sustainability is a new subject in the Oxford International Curriculum (OIC). Let’s delve deeper into this subject with UTS!

Officially launched UTS Saigon South Campus –...

News

24/03/2024

In Binh Chanh district, UTS Saigon South Campus was launched, aiming to become a counterpart of a quality educational institution with international standards for students.

UTS Summer Program 2024: BE AN EXPLORER

Events

17/06/2024

Register before April 30, 2024, to save 15% on tuition for the Summer Program: Be An Explorer!

Open Day – Prepare For First Grade...

Events

08/06/2024

Go To School With Your Child, Have...

Events

16/03/2024

The event is an opportunity for parents to experience subjects in the Oxford International Curriculum to better understand UTS...

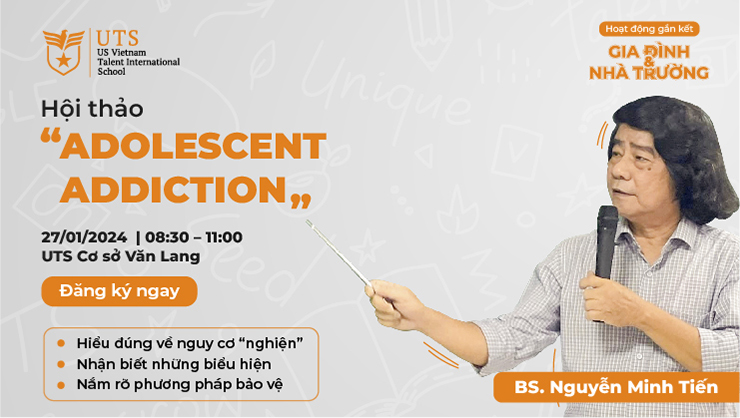

The Connecting Activities Between Family And School:...

Events

27/01/2024

Learn more about “Adolescent Addiction” throughout a seminar at UTS. This phenomenon has gradually become the worry of parents today.

Spring Fair 2024: “Tet in 3 regions”

Events

02/02/2024

The UTS Spring Fair 2024 aims to reproduce the traditional Tet space of 3 regions of the country through typical folk activities...

A peaceful and loving Christmas at UTS

News

01/01/2024

Another Christmas passed by, let's look back at the activities that the UTS Community has participated in together and created a wonderful Christmas season.

Experiential Class For Parents – Wellbeing Class:...

Events

13/01/2024

Learn about "bilingual lessons" in the Wellbeing subject and better understand each study program at UTS at the event. Click for more details.

Medal speak volumes at the National Phu...

News

11/12/2023

In November, UTS-ers showcased their strengths in the field of sports at the District level competition for the National Phu Dong Sports Festival.

Journey To CIS Accreditation | We Are...

News

01/12/2023

From 27th to 30th, November, we are honored to welcome the CIS evaluators to visit UTS Van Lang Complex....

Appreciation week – Make others see the...

News

We understand that not only us who are trying the best on this journey, but our teachers are also doing the best with us every day.

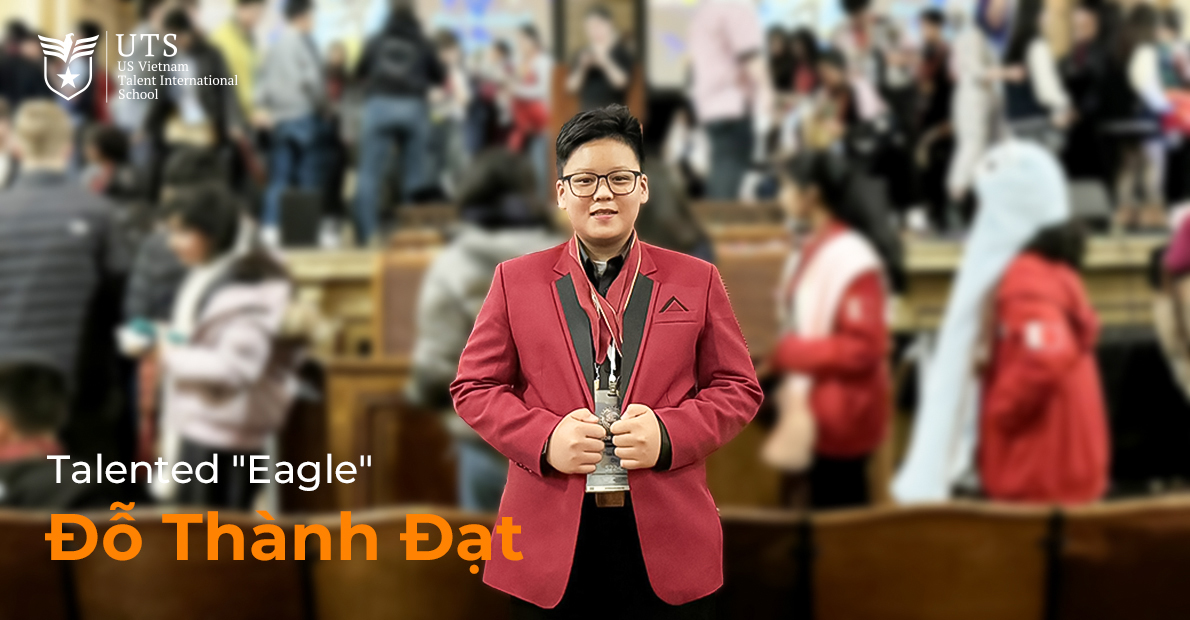

Human of UTS: Talented “eagle” Do Thanh...

News

22/11/2023

Bringing home two medals at the World Scholar's Cup, let's see about the development journey of "eagle" Do Thanh Dat at UTS!

Reading Culture – The strong foundation of...

News

13/11/2023

What is reading culture and why do we need to focus on developing reading culture? How has UTS trained reading culture for students at school?

UTS Appreciation Week: Make others see the...

Events

16/11/2023

Each UTS educator is a caring "nurturer" with the mission of growing the students to be excellent in character and in learning.

Anti-Bullying Week 2023

Events

06/11/2023

Explore Anti-Bullying Week 2023 at UTS: "Make a noise about bullying" - express your thoughts and contribute your voice to the anti-bullying journey at school.

Open Day – The Golden Time To...

Events

18/11/2023

Kindergarten, Primary or High school, 4 years old, 6 years old or 16 years old, what will be the golden time to shape your child's future?

Training on Fire Prevention and Firefighting at...

News

26/10/2023

Equipping students with skills to protect themselves and to handle emergency situation is one of the top priorities at UTS.

UTSPook-a-thon: Let’s get spooky!

Events

30/10/2023

UTS Halloween Festival called "UTSpook-a-thon" carries the meaning of a festive season with many interesting activities for students.

UTS Continues To Be Certified As A...

News

14/10/2023

UTS is proud to be marked the three consecutive years milestone in achieving Microsoft Showcase School....

What a meaningful Saturday of UTS at...

News

07/10/2023

The UTS Community had a fantastic experience at UTS Van Lang Complex with a new friend named Rhino Ranger from Wild Rhino in the Rhino Day.

The House Kick-off Ceremony – Academic Year...

News

15/09/2023

At UTS, each house is a unique color and has its own personality, representing six core values that we always uphold in all activities.

UTS x Wild Rhino: Protecting Rhinos and...

Events

07/10/2023

UTS collaborates with The Wild Rhino to organize Rhino Day: “Protecting Rhinos and other endangered wild animals”.

UTS Full Moon-mory: The moon is on...

News

29/09/2023

Our "UTS Full Moon-mory" symbolizes a Full Moon season filled with the most grateful memory by the beloved family and UTS community.

The Academic 2023 – 2024 Opening Ceremony

News

28/09/2023

The academic year 2023-2024, fulfilled with joy, has begun. Let's think bigger, learn happier, and grow together every day!

Mid-Autumn Festival – UTS Full Moon-Mory

Events

29/09/2023

UTS Full Moon-mory symbolizes a Full Moon season filled with the most grateful memory by the beloved family and UTS community.

Opening Ceremony Of The Academic Year 2023...

Events

05/09/2023

Entering the 6th year of the “Growing talent with care”, the Opening Ceremony of academic year 2023 - 2024 will mark a proud milestone...

Professional Development Weeks 2023 (PD Weeks 2023)...

News

25/08/2023

The Back-To-School Day Of Academic Year 2023...

Events

21/08/2023

To welcome UTS-ers back to school, the “nurturers” have prepared remarkable surprises and meaningful imprints...

Science And Technology Competition

Competition

20/05/2023

This competition was organized for student, which aim to improve problem-solving skill in practical problem in science and technology

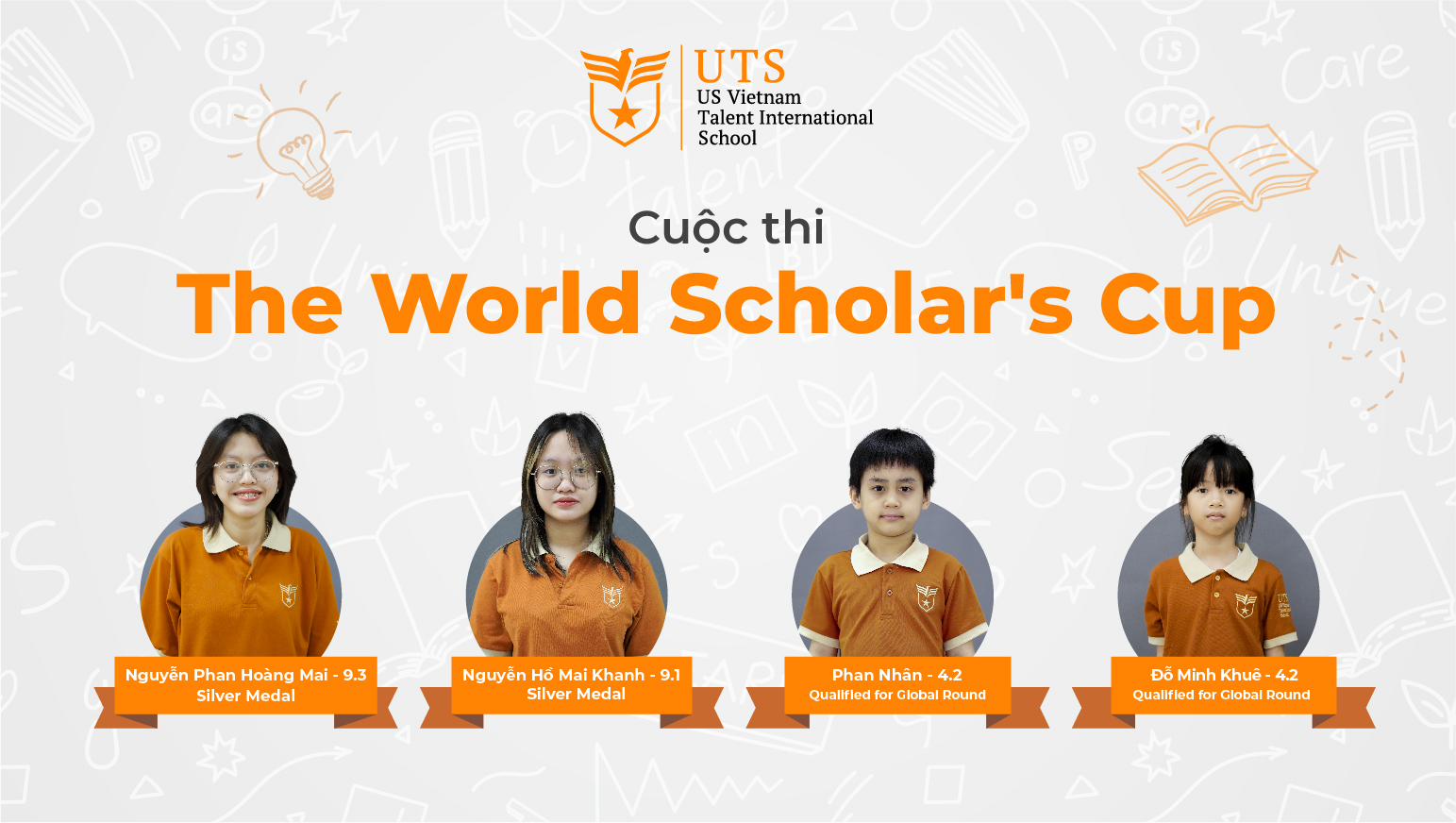

World Scholar’s Cup 2023

Competition

20/05/2023

The World Scholar’s Cup is an international team academic program with more than 15,000 students participating from over 65 countries

Genius Olympiad 2023

News

20/05/2023

GENIUS Olympiad is an international high school project competition about environmental issues.

Open Day – Preparing For Back-to-school Success

Events

22/07/2023

Parents are cordially invited to attend the sharing session about important things to prepare in the upcoming new school year!

Parenting Workshop: The Bittersweet Struggles On The...

Events

13/07/2023

UTS cordially invites parents to participate in the Parenting Workshop: The Bittersweet Struggles on the First Day of Kindergarten.

Do you know? How Does A Sentimental...

News

29/06/2023

%%sitename%% - According to parents’ perspective, what is the root cause of making such a generation gap? Let's explore!

UTS’s Got Talent 2023 | Talented Performances...

News

01/06/2023

Enjoy the 27 finest performances and unexpected moments on the main stage in the final round of UTS's Got Talent 2023!

School Year 2022 – 2023 Closing Ceremony...

News

30/05/2023

The journey to discover the joy of learning for the 2022 - 2023 school year has officially come to an end through the Closing Ceremony. See more here.

Rage Is Just A Simple Emotion!

News

20/05/2023

Learn more about the rage of children and how to react throughout the Parenting Workshop: "How to be friend with your child's rage" at Game bài đổi thưởng Mê đổi thưởng Campus.

TESOLution 2023: When Teaching English Doesn’t Just...

News

24/05/2023

UTS’S GOT TALENT 2023

Events

24/05/2023

UTS'S Got Talent is not only a competition to explore the hidden talent, but also an opportunity, empowers you to express your talents.

Parenting workshop: How to be friend with...

Events

20/05/2023

Passport To The Future

Events

13/05/2023

At the seminar, parents will hear from renowned educators and explore ways to support their children's preparation for the future.

The First English Play At UTS –...

News

15/04/2023

At UTS, students get the chance to showcase their love for art, develop language skills, and gain valuable performance experience before an audience.

A Day Becoming An OIC Student, What...

News

27/03/2023

Know more about OIC program and the joy of learning in UTS throughout the seminar "Raising Kids: Balancing Love and Expectations".

Magic In The Montessori Classrooom At UTS...

News

08/04/2023

UTS Parents Talk | The Key To...

News

07/04/2023

UTS Parents Talk series, which is held by UTS, will be a bridge between parents and children to strengthen their relationships.

UTS GENIUS OLYMPIAD 2023: Gathering The Future...

News

04/04/2023

The “Transceding Time” Journey At UTS Summer...

News

15/06/2023

School Play’s Premier “Snow White And The...

Events

07/04/2023

The play is set in a progressive forest, the plot is transformed around the question “Who has the most business?” instead of “Who has the most beauty of them all?”.

Congratulations UTS Eagles On Entering The Final...

News

15/03/2023

OPEN HOUSE: 3 GOLDEN RULES FOR RAISING...

Events

01/04/2023

The early years are crucial for children as their senses develop. Join the Parenting webinar to prepare for your child’s first school journey.

Do you know? Be positive with your...

News

11/02/2023

Parents, let's find out how UTS maintains a positive learning environment so that students can fully experience joy in their studies and become future talents.

Fulfill The “Season Of Giving” With A...

News

24/12/2022

Let's see how the Christmas atmosphere at UTS has been mellowed by sequences of activities to spread out the love

US Vietnam Talent International School becomes a...

News

27/09/2022

"US Vietnam Talent International School is proud to be officially recognized as a Microsoft Showcase School, exemplifying our dedication to educational excellence"

School Year 2022-2023 Opening Ceremony | The...

News

08/09/2022

"Happiness is not the destination, It’s the whole learning journey at UTS" - Ms. Nguyen Thi Ngoc Lan, Principal of UTS, shared at the opening ceremony.

Welcome to the new school year! Welcome...

News

22/08/2022

Nurturing a love of Learning with the...

News

15/08/2022

The National Program is a standard program under the new curriculum framework of the Ministry of Education and Training for all levels of education

The Journey To Children’s Inner Garden Through...

News

07/01/2023

Children play the role of "little artists" and have interesting experiences at "Wellbeing Day: Your happy languages" at Game bài đổi thưởng Mê đổi thưởng Campus.

UTS Officially Becomes A Member Of The...

News

10/08/2022

US Vietnam Talent International School is delighted and proud to be recognized as an official member of CIS.

Do Parents Know? – Create Home Space...

News

16/07/2022

Let's discover with UTS how creating a comfortable and loving space can help your child realize the right values and develop comprehensively.

UTS-ers Are Full Of Energy With UTS...

News

08/03/2022

Parents are invited to take a look at the opening ceremony of UTS Sports Day 2022 - the most anticipated sports event of the year.

Project-Based Learning (PBL): Students Are Getting Closer...

News

04/07/2022

Project-based learning is an instructional give students the opportunity to develop knowledge and skills through engaging projects

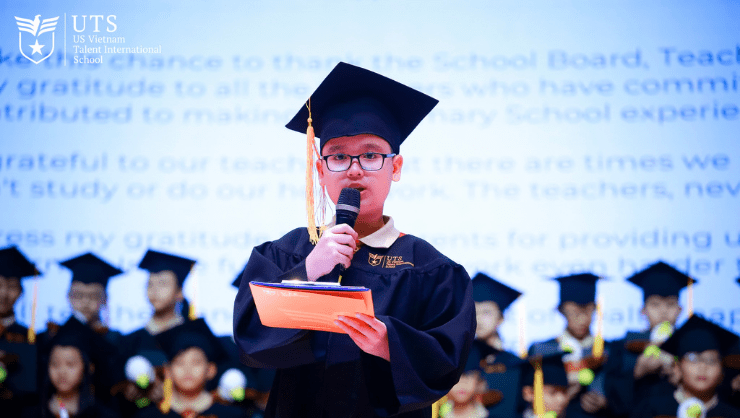

Congratulations to Grade 5, 9 and 12...

News

02/06/2022

At UTS, students in grades 5, 9, and 12 are maturing and ready to explore new things, with grade 12 students nearing their meaningful graduation day.

Closing Ceremony Of The School Year 2021...

News

02/06/2022

The Academic year 2021-2022 Closing Ceremony for Primary Students of UTS took place with many memorable moments. Find out more details here.

Closing Ceremony Secondary Academic Year 2021-2022: The...

News

27/05/2022

UTS-ers Are Full Of Energy With UTS...

News

09/05/2022

Conquering Natural Science Knowledge With The Nobel...

News

05/04/2022

Learn more about Nobel Challenge academic contest for Secondary and high school students at UTS - where natural passion is highlighted!

Experiential Learning: When learning is not only...

News

23/06/2022

Find out how UTS applies the "Experiential Learning" (EL) method in its curriculum, offering an alternative learning approach to traditional teaching models.

Dành cho các bậc phụ huynh: Bé...

News

03/04/2021

Reading – Awaking knowledge and nurturing children’s...

News

17/05/2022

Wonders Quest English Camp: Super Talent Squad

Events

22/05/2022

Wonders Quest English Camp: Super Talent Squad

Events

22/05/2022

An experiential day at Wonders Quest is a day to have fun, participate in the race to explore the “wonders” at UTS and conquer many exciting challenges.

Open Day – Game bài đổi thưởng Mê đổi thưởng Campus

Events

06/08/2022

Coming to the Open Day at Game bài đổi thưởng Mê đổi thưởng Campus, the entire family will participate in creative activities to know more about UTS and the school curriculum.

Experience Day: Exploring Talent Garden – UTS...

Events

18/06/2022

Parents can join the exploring talent garden experience day at Game bài đổi thưởng Mê đổi thưởng Campus here, this event offers exciting activities while addressing parents' inquiries.

Bravery and excellence of UTS’ little actors...

News

09/01/2021

Parents are invited to see the play "Make friends with the sky" which originated from a pilot educational program at UTS and evolved into a truly professional play.

Cross-curricular project “Green trees around us”: For...

News

15/01/2021

Explore the necessity of educating UTS students about the vital role of green trees in promoting a greener future

When Literature is not simply letters through...

News

14/01/2021

In the Literature project, UTS students made models of folk tale to make them more lively! Let's see what they have done.

Math Open Day 2021 at UTS: Fantastic...

News

17/01/2021

Explore the interesting Mathematics – Science space made by UTS students and join the talkshow “What do we learn Mathematics for?” at Math Open Day 2021.

A wonderful and meaningful semester has passed...

News

20/01/2021

In the first semester of the 2020-2021 school year, UTS-ers successfully maintained effective learning and comprehensive personal development.

Explosion of team spirit with tug of...

News

21/01/2021

“Little swimmers” of UTS with Admirable Effort

News

23/01/2021

Meet the little swimmers at “UTS Sport Games 2021”. All of them tried their best to conquer the swimming lane!

Learning about animal protection with glowing colors

News

25/01/2021

Join UTS in an English mini show “Raising an awareness of animal protection” with colorful paintings and enhance loving spirit of animals!

UTS-ers and their “fashion companies”

News

26/01/2021

Learn more about The "startup" story of the fashion brand which was approached by UTS-ers in an engaging and innovative way during an English class

National pride with the shadow puppetry of...

News

27/01/2021

Grade 10 and 11 students at UTS study History through an innovative method in the project "Shadow Puppetry of History".

Making famous literary works come alive by...

News

01/02/2021

Admire the models created by 7th graders of UTS based on Literature program such as Uncle Ho’s simplicity, Non-interference, ...

UTS-ers showing their whorls with unique handmade...

News

03/02/2021

UTS-ers and the “adventure” to most extreme...

News

23/02/2021

Admire students from Class 7.1 and gain more Geography and Science knowlegdes throughout their illustrated models made by environmentally-friendly materials!

Learning enthusiastically, fighting the COVID off!

News

25/02/2021

The UTS community remains dedicated to learning during the pandemic, with students actively engaging in online classes and completing their exercises and assignments.

UTS community safely return to school together

News

01/03/2021

After a month being apart from each other with the Tet holiday and effects of the COVID-19 pandemic, UTS community officially return to school’s campus.

Why should we read books?

News

04/03/2021

In order to nurture love with books in each student, the “Learn to Read” program is integrated in the educational program of all grades at UTS.

Dear our beloved women!

News

05/03/2021

UTS would like to give our honest thank to UTS’ women for their dedication in the nurturing and growing journey of future talents

Be handy with lovely cards of UTS-ers

News

06/03/2021

Join UTS-ers to make lovely cards to give to our beloved woman as best wishes on the International Women’s Day!

Chemistry Club: Learn how to make perfume...

News

10/03/2021

With knowledge about fragrance notes, students create fragrant perfume from alcohol and essential oil and give them to their Mom on the International Women’s Day!

How to learn descriptive writing effectively?

News

11/03/2021

At UTS, descriptive writing is not just thinking and imagining. Join the Writing lesson of class 4.1 to promote this spirit in a creative and realistic way.

World Water Day 2021: Let’s appreciate our...

News

22/03/2021

Let's join UTS-ers to learn about World Water Day on March 22nd and discover the importance of water in our daily lives

Drama “Make friends with the sky” of...

News

23/03/2021

[Human of UTS] – Dang Bao Duy:...

News

25/03/2021

Discover how Bao Duy, a dynamic student and standout actor from UTS in 'Making friend the Sky', manages to balance his academic and personal passions

Learning English with foodscapes!

News

31/03/2021

Join class 6.1 to learn about “foodscape” - thereby developing our creative thinking! This is the first step for UTS-ers to form their various thinking and creativity.

Raising UTS-ers’ awareness about cyber-bullying

News

29/04/2021

UTS Class 9.1 students use the Life Skills subject to express their thoughts and opinions on various forms of cyber-bullying.

M’Drak Kindergarten: The beginning of dreams

News

27/03/2021

Join Van Lang Education Group and US Vietnam Talent International School’s kindergarten project in M'Drak, dedicated to inspiring dreams for over 50 children

Let’s revise English vocabulary of the theme...

News

09/04/2021

Join students of Class 1.1 of UTS to learn and apply new vocabulary of the theme "Food & Drinks" to describe daily meals and express favorite dishes.

The International Kangaroo Math Contest 2021 at...

News

12/04/2021

UTS-ers experience dream jobs in the happy...

News

15/04/2021

UTS-ers meet the champion of the U19...

News

16/04/2021

Reflect on the visit by the PVF Football Academy U19 Team, champions of the U19 National Football Championship 2021, to UTS.

Growing up in the experiential learning trip...

News

17/04/2021

Follow the journey of 5th and 12th graders of UTS in Cu Chi - Ben Duoc tunnels and Hi-Tech Agricultural Zone – WonderPark to gain more interesting knowledge!

Teo is coming back!

News

19/04/2021

Wear green to school – Let’s celebrate...

News

21/04/2021

On International Mother Earth Day, all UTS community members wore green outfits to school to foster "protecting environment" spiri

UTS is full of green on the...

News

22/04/2021

UTS-ers shared about the values of environment and encourage to limit using single-used plastic to protect our ecosystem throughout the project “For everyone’s health”.

UTS-ers “recycling” project: Reduce waste to help...

News

23/04/2022

Let's find out how the students in grade 5.1 of UTS practice the 3R method through the project “Recycling” in English subject.

“Humans of UTS” Rewind: A love story...

News

24/04/2021

Discover “Humans of UTS” - a special project for members of UTS community, bringing lovely stories about the nurturing and developing journey of future talents.

Turning Hobbies Into Passions with UTS-ers

News

03/05/2021

Follow along with the project that UTS Grade 7 and 11 students participated in together during the English project wrap-up session titled "UTS DIARY"

The journey of smiles at UTS

News

27/04/2021

Let’s look back on the journey of smiles at UTS over the year 2021 and together get strength to successfully complete all the challenges ahead!

Which color in the UTS-ers’ world?

News

26/04/2021

Learn more about how the students in grade 8.2 of UTS can grow this special type of intelligence through the lesson “The World in our Eyes”

Unique applications of “little programmers” at UTS

News

04/05/2021

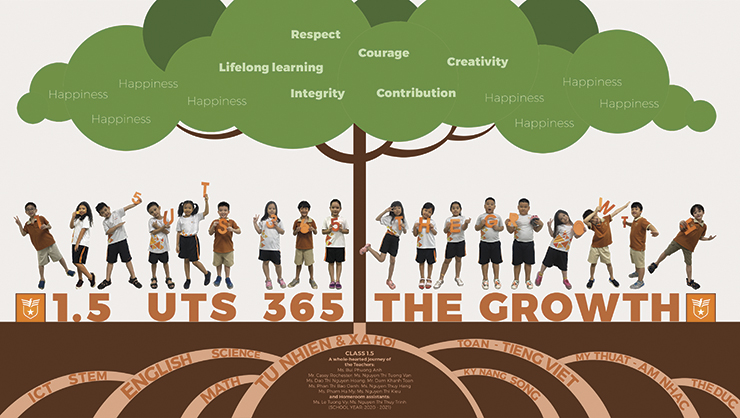

“UTS – 365 The Growth” voting round...

News

08/05/2021

The voting phase for 'UTS – 365 THE GROWTH' has officially started! A big thank you to everyone for your daily efforts to grow and succeed during the last school year.

UTS: Keep the spirit – Together we...

News

10/05/2021

Learn more about how UTS students maintain an optimistic spirit and readiness to adapt to the ever-changing world. Discover their approaches and strategies!

UTS-ers “created” Amazing River & Lake System

News

11/05/2021

Parents are invited to Grade 6.3, where the students at UTS create magnificent river and lake models with their own hands during their Geography class.

Sharing Emotions and Memories with the “UTS...

News

12/05/2021

“Love Giving” Stories-telling Project

News

15/05/2021

At UTS, we are family. Join us in the “Love Giving” stories-telling project, which helps strengthen the connection among students at UTS

Result annoucement of the “UTS – 365...

News

21/05/2021

The “UTS – 365 THE GROWTH” photo contest has officially ended with prizes for classes which have the highest voting results.

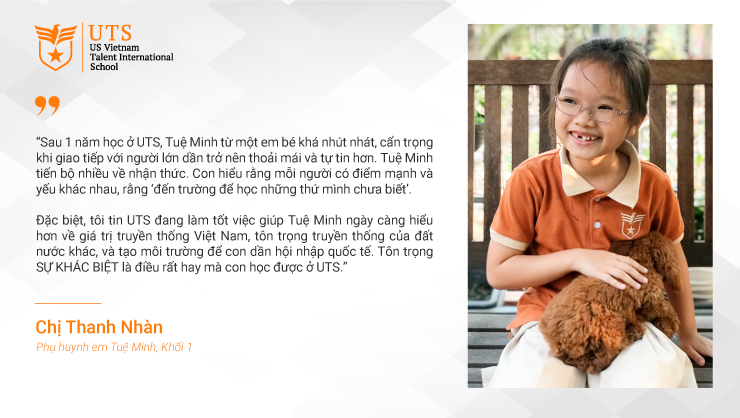

“She has completed the 1st Grade at...

News

24/05/2021

Ms. Thanh Nhan, parent of Tue Minh - a 1st grade student shared about her daughter's change after 1 year of studying at UTS.

[Humans of UTS] – UTS Homeroom Assistance...

News

25/05/2021

"We love UTS’ students as our own kids. Therefore, we always strive to make them feel happy at school." - shared Mrs. Quyen - Homeroom Assistance staff.

Benefits of inter-level bilingual school at UTS

News

18/04/2022

Explore how UTS's education programs from Primary to High School support the growth and development of our little ‘talents’

Saving sweet memories with UTS-ers

News

18/04/2022

The 2020-2021 school year is an important milestone for UTS students in grades 5, 9, and 12 as they complete their respective levels of education.

Accompanying children in the environmental protection journey

News

18/04/2022

Oxford International Curriculum

News

18/04/2022

Becoming Oxford University educational partner, UTS officially implements the Oxfoxd International Curriculum form School Year 2021-2022.

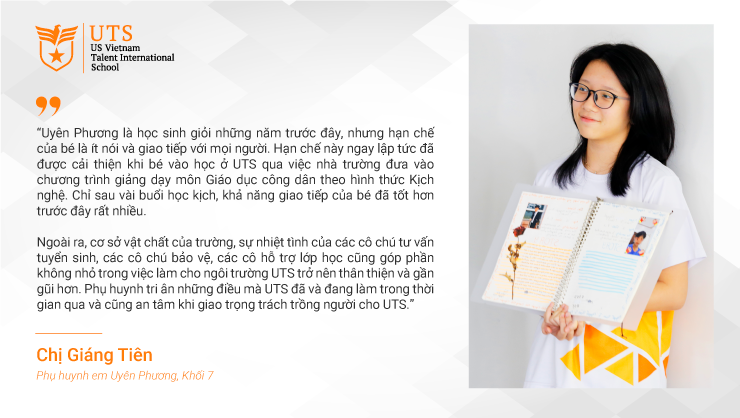

“I feel sastified when trusting UTS to...

News

18/04/2022

Congratulations Luong Dang Huy (Grade 11) on...

News

08/06/2021

Have parents talked to children about Gender...

Events

23/07/2021

Parents, let's explore how at UTS, children receive comprehensive sex education from grades 1 through 12, with age-appropriate approaches for each stage.

Online talkshow: When education is defined by...

Events

13/08/2021

Cùng tìm hiểu sự quan tâm được thực hiện ở UTS như thế nào thông qua chương trình trực tuyến: “Khi Giáo dục được định nghĩa bằng sự quan tâm”

Talkshow: raising the child like a tree

Events

08/01/2022

Do Parents Know? Don’t Turn Disagreements Into...

News

25/02/2022

LIFELONG LEARNING HUB | HOW DO GRADE...

News

12/02/2022

UTS is confident that teachers' attention, love, and patience will guide Grade 1 students on their educational journey with strong steps.

Do Parents Know? Guiding Your Children Effective...

News

10/02/2022

Explore how UTS helps students form an understanding of money, develop thoughtful values, and establish financial awareness.

“Hands-on” methodology – Excite creativity and help...

News

17/01/2022

Find out how UTS has applied the method “Hands-on” at the high school level to help students be independent, creative take initatives and solve problems

Space repetition method – Best “tips” for...

News

07/01/2022

Learn more about spaced repetition method - the "key" to help students overcome memorizing difficulties while reviewing and also while sitting the exam.

DO PARENTS KNOW? | HELP CHILDREN PLAN...

News

03/12/2021

UTS believe that children not only need to be educated with academic knowledge but also need to have skills in self-development and unleashing their potential.

HISTORY 4.0 – THE SEEMINGLY BORING SUBJECT...

News

30/11/2021

UTS is the first international school in Ho Chi Minh City to pioneer the introduction of shadow play into teaching history and initially achieve encouraging results.